Welcome BMI Federal Credit Union Members!

Getting Started

It is easy to open your Health Savings Account (HSA) at BMI Federal Credit Union. We are here to walk you through the process.

- About 10 to 15 minutes to complete the process

- For online applications, a secure WiFi connection (public WiFi connections are not secure, even on private devices - we always recommend a private WiFi connection for all financial activity)

- If your an existing member you will need your BMI FCU account number

- A driver's license or valid form of government ID

- Your Social Security Number

1. Open Your HSA Account Online

Open your new account with BMI FCU online by clicking the button below and follow the prompts if you are not a member of BMI Federal Credit Union. If you are an existing member and just need to add an HSA follow the instructions below the open a new account instructions.

Open New Account

New Members - Follow These Steps

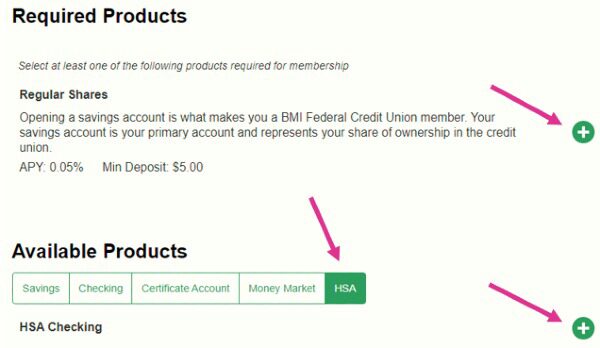

Each BMI Federal Credit Union membership begins with a Regular Share Savings account. When prompted, add your Regular Share Savings account along with your Health Savings Account. Click the  icon to add your products. You must add a Regular Share Savings and a HSA account.

icon to add your products. You must add a Regular Share Savings and a HSA account.

Submit Your Personal Information

Follow the prompts to add the additional required information.

Fund Your Regular Share Savings Account

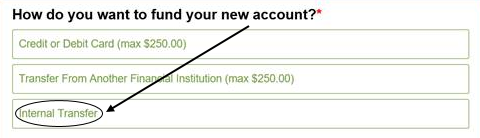

This account requires a one-time $5.00 deposit to establish credit union membership - and we've got you covered! Follow these instructions to fund this account on us:

- When you reach the menu options to fund your account, select Internal Transfer

- You will then be asked to enter the Account Number and the Account Type

- In the Account Number field, enter 999999

- In the Account Type field, select Savings

Review and Submit

Add HSA Account to Your Existing BMI FCU Account

Add your HSA account online by clicking the button below and follow the prompts.

Add HSA

Add Your Products

You will be prompted to add your HSA product, and indicate if you would like an individual or family HSA. You will be the primary account holder.

Submit Your Personal Information

Follow the prompts to add the additional required information.

Review and Submit

2. Share your account information with your employer to process your payroll deductions. Your employer contributions will not be deposited until you provide your employer with your BMI FCU account information.

Authorize BMI FCU to provide your employer with your HSA Account Information

Complete the Authorization form giving BMI Federal Credit Union permission to share your HSA account number with your employer for this conversion. This permission will simplify the process for HSA contribution setup. Please submit this form to a branch, or send it through our Message Center.

3. Transfer your Existing HSA to your new BMI Federal Credit Union HSA

If you have an existing HSA, you can transfer those funds to your new BMI Federal Credit Union HSA. Fill out the HSA Transfer Request Form, and submit it to the financial institution of your existing HSA to authorize transfer of funds.

4. Get an Additional HSA Debit Card

To request additional cards for authorized users, the primary card holder must complete the HSA Visa Debit Card Authorization form, for Family Plan HSA accounts only. You will need the SSN and the signature for the new/added authorized user. Please submit this form to a branch, or send through our Message Center.

Learn More About Your HSA

Read about eligibility, contributions, distributions and more in our full brochure. For the full publication of guidelines and benefits for HSAs, visit www.irs.gov.

If you have an existing account with BMI Federal Credit Union, you can easily add an HSA to your membership. You can also transfer any existing HSA funds, or request additional debit cards for authorized users.

Who to Contact

Contact YOUR Business Development Manager or visit us at any of our five branches in Dublin, Westerville, or Columbus. You also have access to the second largest Shared Branching Network with nearly 30,000 surcharge-free ATMs and over 5,600 shared credit union branches.